However, any losses and/or deductions not allowed because of the basis limit can be carried forward indefinitely and deducted in a later year subject to the taxpayer's basis limit for that year.

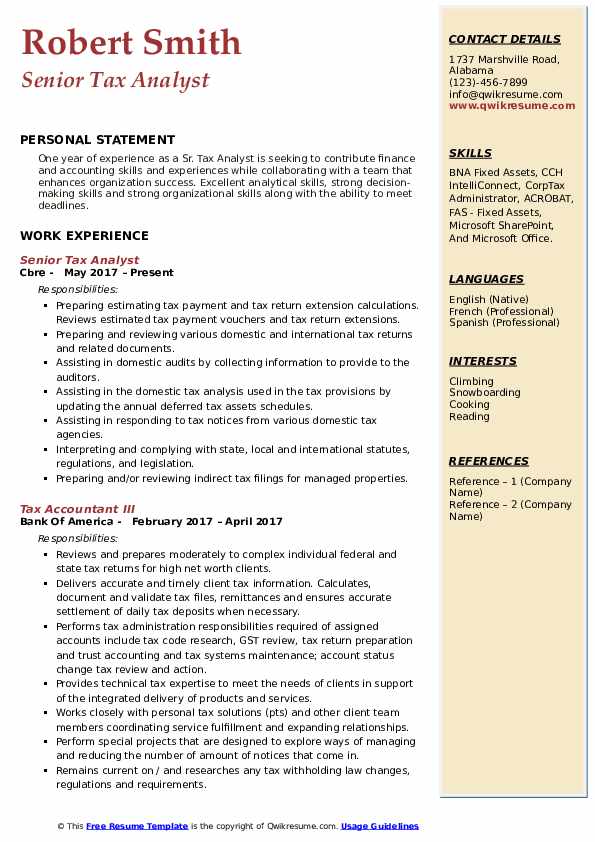

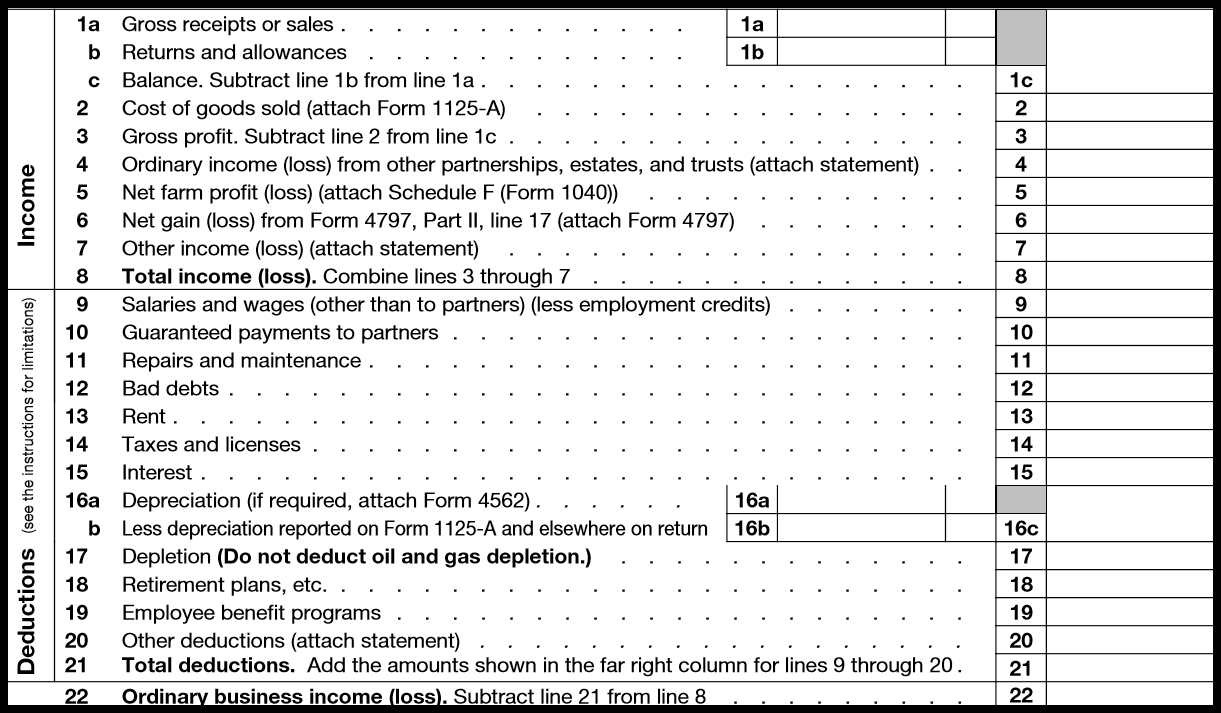

Although the partnership does provide an analysis of the changes to the partner's capital account in item L of Schedule K-1, that information is based on the partnership's books and records and cannot alone be used to figure the taxpayer's basis.Ī taxpayer's basis in a partnership consists of the net cash that the partner has contributed to the partnership entity plus the adjusted basis of any property that the partner has also contributed to the entity. Generally, a taxpayer may not claim their share of a partnership loss (including a capital loss) to the extent that it is greater than the adjusted basis of their partnership interest at the end of the partnership's tax year. However, the partnership isn't responsible for keeping the information needed to figure the basis of the taxpayer's partnership interest. See: Instructions for Form 1065 – US Return of Partnership Income. When completing the Form 1065 - US Return of Partnership Income, each partner is required to be given a Schedule K-1 (Form 1065).

0 kommentar(er)

0 kommentar(er)